By Gillian Petit | Institute for Research on Public Policy

Budget 2025 built on a previous announcement to transition to “automated federal benefits” to make it easier for Canadians to file tax returns and access financial benefits. Starting in the 2026 tax year, pre-filled tax returns will be available on the Canada Revenue Agency’s (CRA’s) My Account online filing system and automatically filed for about one million lower-income individuals with simple tax situations. This offering will be scaled up to about 5.5 million individuals for the 2028 tax year.

This commentary addresses four questions:

- How is automatic tax filing different from the current regime?

- Why do we need automatic tax filing?

- Where do barriers and complexity remain?

- Where is there room for improvement?

Related reading

What history tells us about tax, trouble and the top one per cent

By Shirley Tillotson, Professor of history at Dalhousie University; expert advisor at the Canadian Tax Observatory | A version of this piece was originally published in the Halifax Examiner, February 25, 2026

February 25, 2026

Overview of the Quebec tax system – 2026 edition

An analysis led by Tommy Gagné-Dubé and Suzie St-Cerny for the Research Chair in Taxation and Public Finance at the University of Sherbrooke.

January 9, 2026

Rethinking Canada’s Tax System: What Works, What Doesn’t, What’s Next

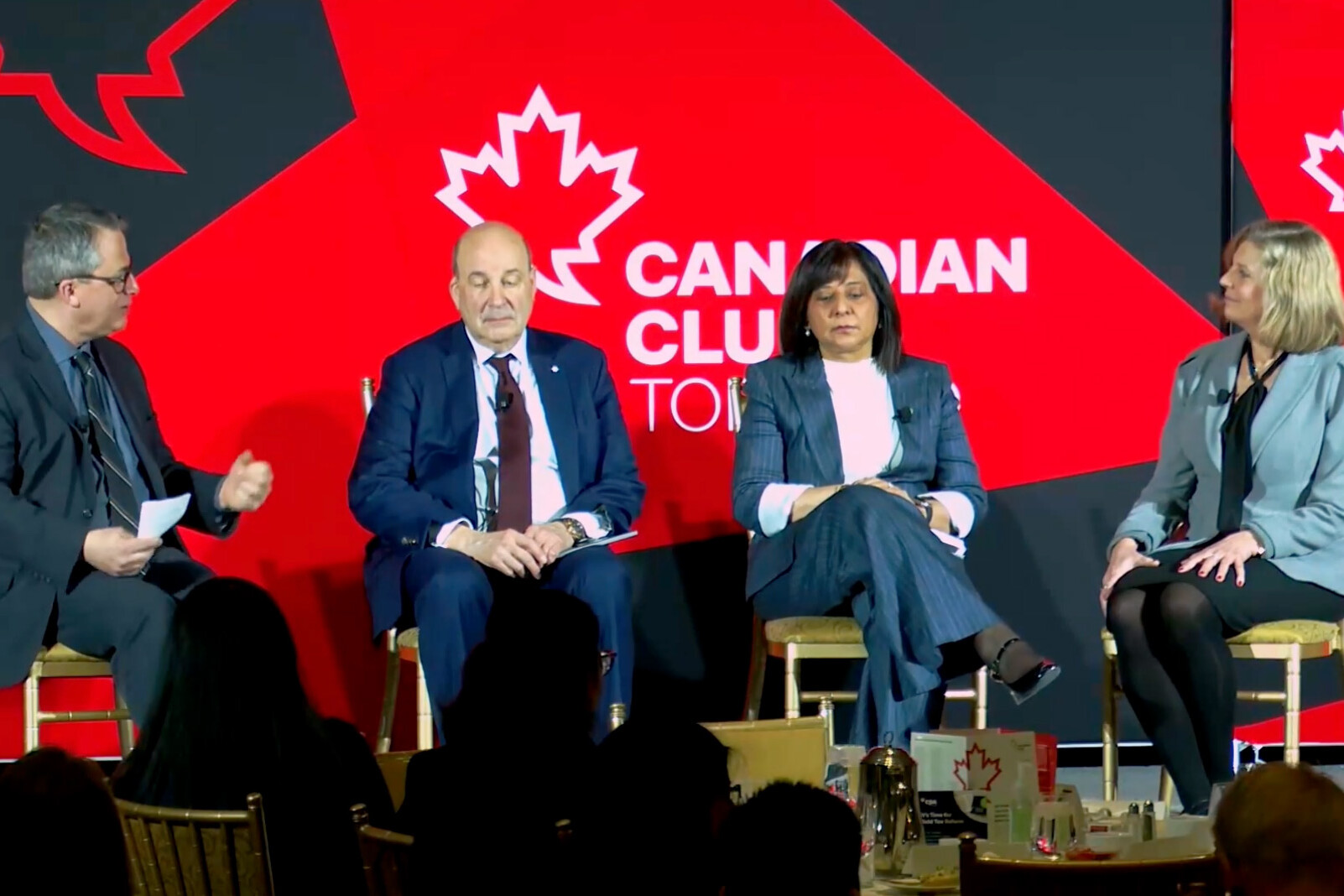

The Canadian Club of Toronto hosted a panel on rethinking Canada’s tax system (what works, what doesn’t, what’s next), featuring the Canadian Tax Observatory’s Heather Scoffield, Deloitte’s Fatima Laher and the University of Calgary’s Jack Mintz. Moderated by Patrick Brethour of the Globe and Mail. Here’s a recording.

February 24, 2026

Get in Touch

Have feedback on the work we are doing? Interested in collaborating? We want to hear from you.