Those of us who make a habit of sifting through government speeches and documents in search of clues for the upcoming federal budget can safely assume: this year, it’s all about investment.

And that makes sense. Investment was a central theme in Prime Minister Mark Carney’s election campaign as well as the focus of major legislation and government initiatives since.

He reiterated his goal again on Wednesday night in a key pre-budget speech, committing to a budget that would “catalyze unprecedented investments.”

More importantly, business investment has been dragging in Canada for many years, and now, in the face of a reordering of the global economy and an unpredictable trade war with our closest economic partner, Canada really needs to do something about it.

The assumptions should end there though.

Improving Canada’s investment track record is anything but straightforward. The policy solutions aren’t as simple as slashing the corporate tax rate in the name of “tax competitiveness” with the United States, and assuming business investment in Canada will follow.

For one, that’s not been our recent history.

Improving Canada’s investment track record is anything but straightforward. The policy solutions aren’t as simple as slashing the corporate tax rate in the name of “tax competitiveness” with the United States, and assuming business investment in Canada will follow.

Canada’s tax regime was considered more competitive than the United States for many years, and then roughly on par until recently. But business investment did not boom. It did exactly the opposite.

Nowadays, the spectre of Donald Trump’s One Big Beautiful Bill Act (OBBBA) hovers over Canadian investment intentions, with its many, many tax measures designed to flatter American taxpayers.

And like everything that happens in U.S. economic policy, there are implications of the OBBBA for Canada. Canadian companies and cross-border investors are busy digging through the details of the massive $3.7-trillion (US) bill to figure out how to take advantage of the new rules.

And in the meantime, corporate leaders in Canada are urging governments on this side of the border to cut the corporate tax rate.

The thing is, Canada’s overall tax competitiveness is still in ok shape, at least according to a recent, thorough and fairly orthodox comparison of tax regimes among rich countries of the world. The U.S.-based Tax Foundation’s International Tax Competitiveness Index 2025 released last month put Canada at 13th place out of 38 countries, while the United States places 15th.

At the same time, Trump’s erratic approach to tariffs acts much like an unpredictable tax on investment that makes Canada’s relative stability look enticing.

Regardless, there are myriad elements that influence decisions to expand in Canada. Research into Canada’s lacklustre business investment frequently looks at all sorts of things: propensity to innovate; availability of capital, labour, skills, infrastructure and, natural resources; our productivity rates; community; access to foreign markets….and on and on.

Corporate tax is just one of many factors.

Still, if there’s one area where the One Big Beautiful Bill Act has squeezed Canada, it’s the treatment of depreciation. The Act significantly enhances immediate write-downs and makes them permanent.

And if there’s one type of tax that Canada could use effectively to directly target and encourage investment, it’s the treatment of depreciation. Capital cost allowance is a tax deduction that allows businesses to write off their depreciable assets over time, and Canada has recently moved toward permanent and accelerated write-downs for some types of property.

But Canada’s provisions are not as broad as in the United States, nor are they as predictable.

If it’s investment that Carney is after, then he’s better off targeting it directly through the accelerated capital cost allowance regime – and not simply hope that a correlation between corporate tax rates and investment that has been unreliable in the past will suddenly be successful.

To put it mildly: that would not be a safe assumption.

Related reading

Rethinking Canada’s Tax System: What Works, What Doesn’t, What’s Next

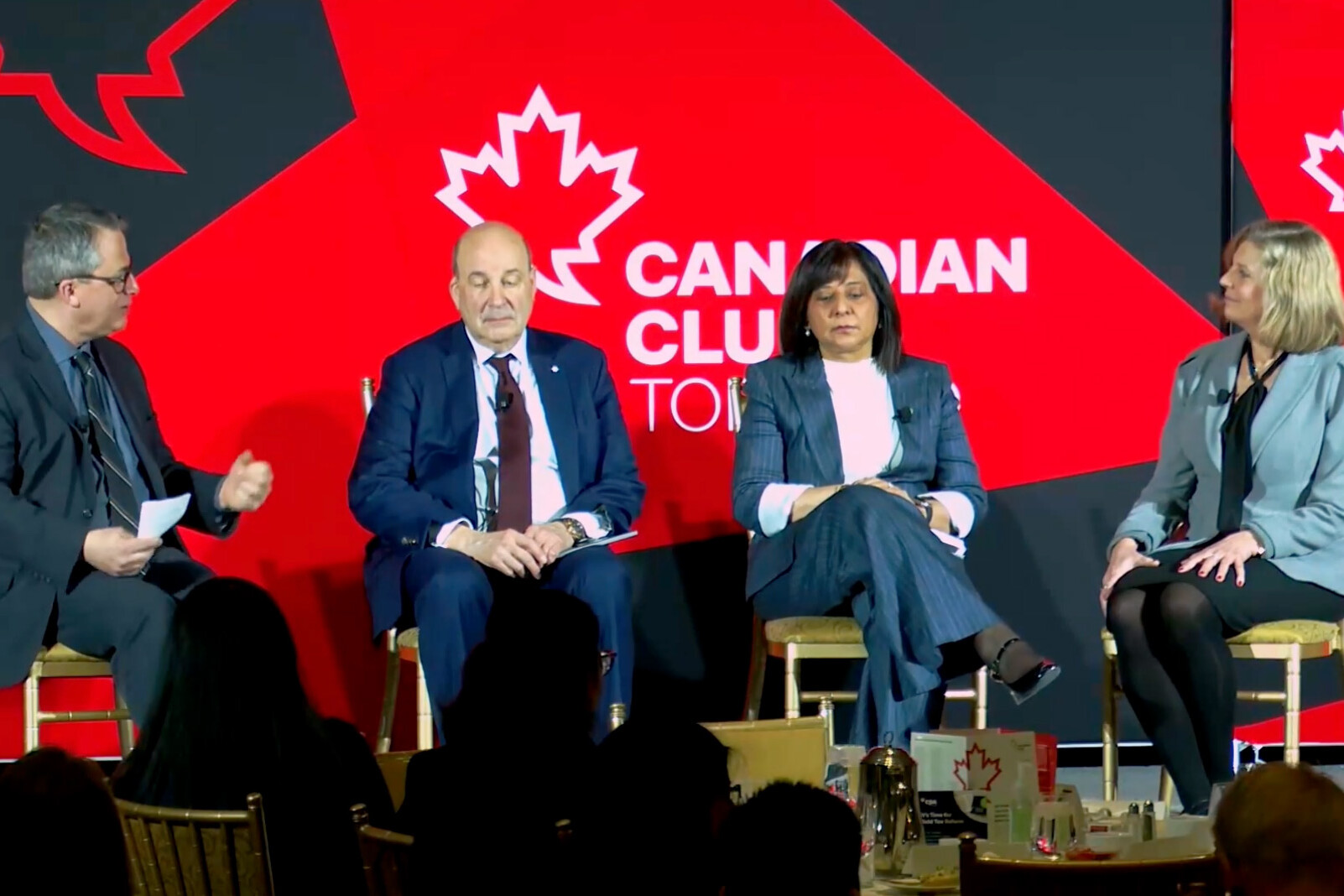

The Canadian Club of Toronto hosted a panel on rethinking Canada’s tax system (what works, what doesn’t, what’s next), featuring the Canadian Tax Observatory’s Heather Scoffield, Deloitte’s Fatima Laher and the University of Calgary’s Jack Mintz. Moderated by Patrick Brethour of the Globe and Mail. Here’s a recording.

February 24, 2026

Heather Scoffield talks the U.S. Federal Reserve on TVO’s The Rundown

What happens to Canada’s approach to monetary policy when the world’s most powerful central bank, the U.S. Federal Reserve, is in turbulent times? Heather Scoffield breaks it down here for The Rundown on TVO.

February 2, 2026

Three things Canadians should know about Carney’s new GST credit

The House of Commons has agreed to fast-track legislation to boost the GST credit for 12 million taxpayers with low and modest incomes. Here’s Heather Scoffield’s initial analysis of the measure.

January 28, 2026

Get in Touch

Have feedback on the work we are doing? Interested in collaborating? We want to hear from you.